Everyone Wants to Do It “Right”

Who doesn’t want to do things right, right?

Who doesn’t want the best, most optimized solution?

Investors today are genuinely trying to do it right. SIPs run automatically, portfolios are diversified, and market volatility is met with calm reminders about long-term thinking. In absolute terms, people today have more access to the tools and knowledge needed to start investing than a decade ago. Blame it on lack of knowledge back then or blame it on lack of tech. Either way, the bottom line is that we’re better off today.

But the question remains: is “better” good enough?

When you review your portfolio, are you actually satisfied with what you see, or does the performance feel underwhelming, not because something is wrong, but because you expected something else?

If Investing Were About Intelligence, This Would Be Easy

Investing is often perceived as a game of wits and intelligence. Complex charts, fancy ratios, and people throwing jargon like confetti create the illusion that markets reward the smartest people in the room. And if that were true, the smartest people would be the richest.

But alas, reality begs to differ. Markets don’t reward intelligence alone; they reward discipline and conviction. Panic, uncertainty, and fear hold the power to destroy even the most well-built portfolios.

As Gabbar so famously said, “Jo darr gaya, samjho marr gaya.”

The Comparison Trap No One Talks About

In today’s fast-paced, globally connected world, it’s become dangerously easy to lose sight of what actually matters in investing. Investing no longer happens in isolation; it happens in constant comparison.

Someone caught a PSU rally early. Maine kyun nahi kiya?

Someone doubled money in a mid-cap fund. Why did I play it safe in large-caps?

Screenshots and stories circulate daily, people did this and got XYZ returns.

Against this backdrop, something strange happens. Our returns don’t change, but our perception of them does. What once felt satisfying now feels mediocre, not because outcomes worsened, but because the reference point quietly moved.

Brilliance Doesn’t Win. Mindset Does.

The markets reward audacity more than they reward brilliance, not audacity as in reckless risk-taking.

The edge isn’t about finding smarter strategies or better products. It’s about staying consistent, resisting the urge to “fix” what already works, and accepting that good investing often feels slow, uneventful, and uncomfortable.

This is where most people slip, not because they don’t know what to do, but because they can’t sit still long enough.

The Cost of Exiting Early

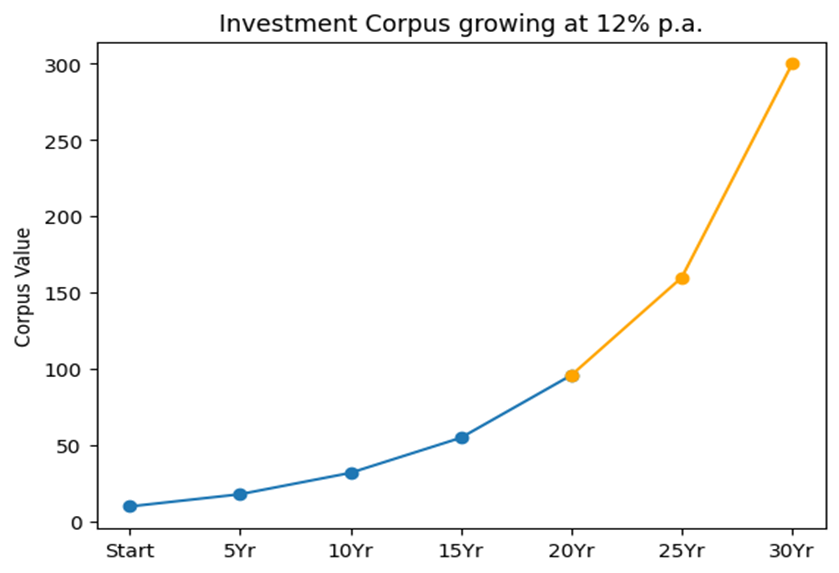

Imagine this. You invest ?10 lakhs today and stay invested for 10 years. Then a crash hits, panic kicks in, and you exit. At 12% p.a., your money grows to roughly ?31 lakhs. Triple in 10 years, decent, right?

DHAPPA!

That same ?10 lakhs would have become roughly ?96 lakhs in 20 years and around ?3 crores in 30 years.

The market will crash. There might be a calamity every 8–10 years that shakes the world. The real question isn’t whether crashes happen; it’s whether you can stay invested through them.

Wealth Is Simple. Behaviour Is Not.

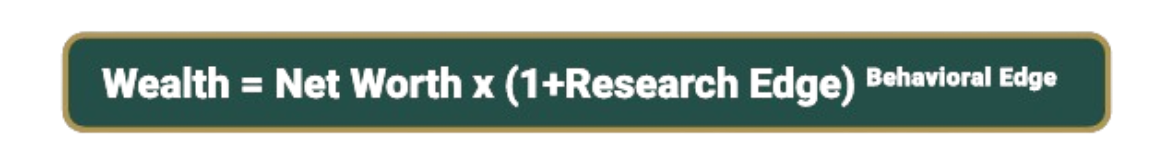

Wealth creation is simple. It needs just three variables working together. But making those variables work in sync, that’s where the difficulty comes in.

Your research edge gives you returns, but your behavioural edge decides your fate.

Notice how behaviour is an exponential factor.

One bad decision can undo years of sensible investing, and unfortunately, this is the edge most investors miss. When markets fall, news channels scream, WhatsApp forwards multiply, and suddenly everyone becomes an economist. That noise is precisely when investing stops being about analysis and becomes about everything but numbers.

Don’t Walk Out Before the Climax

Judging your investments mid-crisis is like walking out of a movie mid-picture the story hasn’t played out.

Climax toh dekh ke jao.

“Long-term investing” sounds easy haan haan, long-term kar lenge until you actually have to live through it.

Sideways markets, boring years, and long stretches where nothing seems to be working test patience not intellectually, but emotionally. Yet wealth is being built quietly, slowly, invisibly. We’ve heard it all our lives “sabar ka fal meetha hota hai.”

Ab zara sabar karke fal chakh bhi lo.

Time: The Most Ignored Ingredient

Money is visible, so we obsess over it.

Returns are visible, so we track them endlessly.

Time isn’t visible, so we undervalue it.

But the truth is the opposite. Time gone is gone forever, money can be earned again, and returns will come and go.

Eventually, returns don’t come from what you buy, they come from how you behave after you buy. Diamonds are made under pressure over an unbelievably long period of time, and yet, don’t we love the final product?

The Real Secret, Said Simply

Compounding doesn’t need brilliance; it needs time and the courage to stay put.

Or as Rancho from 3 Idiots would put it best:

“Returns ke peechhe mat bhaago.

Compounding ke peechhe bhaago.

Returns jhak maar ke tumhare peechhe aayenge.”

That’s the lesson most investors learn too late.

And the ones who learn it early, rarely make noise about it.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: